The balance sheet shows the financial condition of a company at a particular date in terms of assets, liabilities, and the ownership equity. If bookkeeping keeps getting pushed aside as your business starts growing and you simply can’t find the time to get your books in order every month, you should consider hiring a professional to help you. At tax time, the burden is on you to show the validity of all of your expenses, so keeping supporting documents for your financial data like receipts and records is crucial. Finally, if you want someone else to do your bookkeeping for you, you could sign up for a cloud-based bookkeeping service like Bench.

- Bookkeeping and accounting are similar, but bookkeeping lays the basis for the accounting process—accounting focuses more on analyzing the data that bookkeeping merely collects.

- The bookkeeper is responsible for ensuring all transactions are recorded in the correct day book, suppliers ledger, customer ledger and general ledger.

- The daybooks consist of purchases, sales, receipts, and payments.

- Most businesses now use specialized bookkeeping computer programs to keep books that show their financial transactions.

- The bookkeeping transactions can be recorded by hand in a journal or using a spreadsheet program like Microsoft Excel.

- In general, a bookkeeper records transactions, sends invoices, makes payments, manages accounts, and prepares financial statements.

retained earnings is the process of recording and organizing a business’s financial transactions. We recently revised this page to include a few more bookkeeping tips. We also added an FAQ section to help explain why bookkeeping is so important for small businesses and when it’s time to hire a bookkeeper or accountant instead of going it alone. With a cloud-based accounting system like Debitoor, it’s easy to record income, expenses, and use automatic bank reconciliation to make sure your credits equal your debits. Bookkeeping is the recording, on a day-to-day basis, of the financial transactions and information pertaining to a business. It ensures that records of the individual financial transactions are correct, up-to-date and comprehensive. The amounts in each of the accounts will be reported on the company’s financial statements in detail or in summary form.

They assume that keeping a company’s books and preparing its financial statements and tax reports are all part of bookkeeping. You also have to decide, as a new business owner, if you are going to use single-entry or double-entry bookkeeping.

Introduction To Bookkeeping

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. The process of accounting is more subjective than bookkeeping, which is largely transactional. In this guide, we’ll explain the functional differences between accounting and bookkeeping, as well as the differences between the roles of bookkeepers and accountants. Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

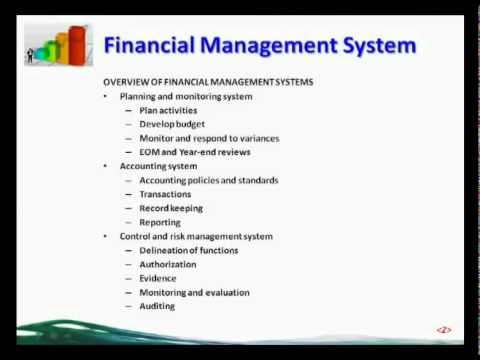

Financial Charts

Mixing together personal and business expenses in the same account can also result in unnecessary stress when you need to file taxes or do your bookkeeping. It could mean a business expense gets lost in your personal account and you miss out on an important deduction. Lenders and investors want a clear idea of your business’ financial state before giving you money. They can’t do that without looking into things like revenue, cash flow, assets and liabilities, which they’ll search for on your balance sheet, income statement and statement of cash flows. If you need to borrow money from someone other than friends and family, you’ll need to have your books together. Doing so lets you produce financial statements, which are often a prerequisite for getting a business loan, a line of credit from a bank, or seed investment. The accounting function can also be outsourced to a private entity.

If your business utilizes Xero, you might consider Bookkeeper360 for your business https://simple-accounting.org/ services. Bookkeeper.com offers business owners a full range of bookkeeping services—including virtual bookkeeping and accounting, tax preparation and planning, financial planning and investment, as well as payroll. If bookkeeping begins taking up too much of your time as your business grows, it may be a good idea to hire help. Hiring an educated accountant will allow you to gain a more complete and accurate picture of your business’s financial health.

More Time

The double entry system of bookkeeping is based on the fact that every transaction has two parts, which therefore affects two ledger accounts. Essentially, bookkeeping means recording and tracking the numbers involved in the financial side of the business in an organised way. It is essential for businesses, but is also useful for individuals and non-profit organisations. Each transaction, whether it is a question of purchase or sale, must be recorded. There are usually set structures in place for bookkeeping that are called ‘quality controls’, which help ensure timely and accurate records. After all of the adjustments were made, the accountant presented the adjusted account balances in the form of financial statements.

You can use the pricing tool on the Bookkeeper360 website to test out all the pricing combinations for each plan. With all of Bookkeeper.com’s online cash basis vs accrual basis accounting services, you receive access to a web-based platform that works with QuickBooks and Microsoft Office and is customized to your business model and accounting needs. As part of each of these plans, however, Bench offers professional bookkeepers to get you set up and work on your books. Bench also includes visual reports, a mobile app, automated statement imports, customer support, a dedicated login for your CPA, and tax-ready financial statements. What’s more, Fundera readers can get the first three months for 30% off.

Handwriting the many transactions into journals, rewriting the amounts in the accounts, and manually calculating the account balances would likely result in some incorrect amounts. To determine whether errors had occurred, the bookkeeper prepared a trial balance.

One important thing to note here is that many people who intend to start a new business sometimes overlook the importance of matters such as keeping records of every penny spent. Purchase ledger is the record of the purchasing transactions a company does; it goes hand in hand with the Accounts Payable account. As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created. Column One contains the names of those accounts in the ledger which have a non-zero balance.

Single-entry is much like keeping your check register. You record transactions as you pay bills and make deposits into your company account. It only works if your company is relatively small with a low volume of transactions. At the end of the appropriate time period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm. The accountant also prepares year-end financial statements and the proper accounts for the firm. The year-end reports prepared by the accountant have to adhere to the standards established by the Financial Accounting Standards Board .

You should also create a ledger or spreadsheet for each of your major accounts.Keeping this ledger will allow you to monitor the current state of your business. You won’t have to wait for the monthly bank statement to see if your business is insolvent or thriving. For example, small businesses usually have a checking account to pay bills and a savings account to save up money to pay self-employment tax. Proper record-keeping for small businesses makes the process easier and keeps you compliant with the law. You never want to waste time chasing down last month’s missing invoice, and you certainly don’t want to find yourself in trouble with legal requirements. Visit SBA.gov to find out more about how small businesses can stay legally compliant. This document summarizes your business’s assets, liabilities, and equity at a single period of time.

If two sides of the equations don’t match, you’ll need to go back through the ledger and journal entries to find errors. Post corrected entries in the journal and ledger, then follow the process again until the accounts are balanced. Then you’re ready to close the books and prepare financial reports. To record a transaction, first determine the accounts that will be debited and credited. For example, imagine that you’ve just purchased a new point-of-sale system for your retail business.

If an account has a debit balance, the balance amount is copied into Column Two ; if an account has a credit balance, the amount is copied into Column Three . The debit column is then totalled, and then the credit column is totalled. The two totals must agree—which is not by chance—because under the double-entry rules, whenever there is a posting, bookkeeping the debits of the posting equal the credits of the posting. If the two totals do not agree, an error has been made, either in the journals or during the posting process. The error must be located and rectified, and the totals of the debit column and the credit column recalculated to check for agreement before any further processing can take place.

Again, as we’ve seen, certain bookkeeping services only work with specific accounting platforms, whereas some bookkeeping services come from an accounting software provider. If you already have a preferred accounting software, you’ll want to keep that in mind as you compare your options.

Newton’s law holds that “for every action , there is an equal and opposite reaction.” Likewise, in double-entry accounting, any transaction in one account requires an equal and opposite entry in another account. It isn’t physics, but for managing a business, it’s just as important. With single-entry http://demosite.center/wordpress/2021/01/18/what-are-retained-earnings/, you enter each transaction only once. If a customer pays you a sum, you enter that sum in your asset column only. This method can work if your business is simple—as in, very, very simple. If you work out of your home, don’t have any equipment or inventory to offer, and don’t venture too frequently into the realm of cash transactions, you might consider single-entry bookkeeping. Bookkeeping includes the recording, storing and retrieving of financial transactions for a business, nonprofit organization, individual, etc.

Plus, most accounting software starts you off with double-entry bookkeeping anyway. With the software all ready to go, you can tackle double-entry bookkeeping with no sweat. Bookkeeping begins with setting up each necessary account so you can record transactions in the appropriate categories.

One of the important habits you should develop when you start a business is recording transactions in your general ledger. The ledger and its accuracy are central to your company’s finances. the work or skill of keeping account books or systematic records of money transactions . As we’ve seen, the price for bookkeeping services can range—and in general, require a significant monthly cost. You’ll want to think about what you can afford, as well as how an accounting software subscription factors into that cost. Although the monthly cost of QuickBooks Live may seem high at first glance, it actually falls in-line with many of the other bookkeeping services on this list. Additionally, like Bookkeeper.com, Bookkeeper360 is a great solution for businesses that want related services on top of general bookkeeping.

As the business grows, however, it may become less important to know the exact cash balance of the company and focus instead on its current health. By tracking expenses when they occur and revenues when they are earned, rather than paid for, the accrual method negates the effects of payment delays in determining the financial health of the company. You don’t want to lose receipts, forget to record transactions, or record the same transaction twice, as this could cause a misrepresentation of your business’s financial health. You may need to meet with the company’s accountant once a month to go over the books. The accountant can identify any recordings that are unclear or inaccurate, and you can talk about them.

No longer will hours be spent looking for errors that occurred in a manual system. After each year’s financial statements were completed, closing entries were needed. The purpose of closing entries is to get the balances in all of the income statement accounts to be zero before the start of the new accounting year. The net amount of the income statement account balances would ultimately be transferred to the proprietor’s capital account or to the stockholders‘ retained earnings account. At mid-size and larger corporations the term bookkeeping might be absent. Often corporations have accounting departments staffed with accounting clerks who process accounts payable, accounts receivable, payroll, etc.

Merritt Bookkeeping: Best For Businesses On A Budget

It also includes the presentation of the financial health of a company, which involves preparing financial statements, andindicatorsthat can be derived from them. Furthermore, a function of accounting is the preparation of tax and other required financial materials. Small businesses may have both bookkeeping and accounting functions, and they are synergistic. What accounting software, if you already use one, do you use?

You also may be able to prevent or uncover fraud, whether from customers, vendors, or employees. Unless you’re specially trained in accounting principles, bookkeeping can be a challenging task. So consider getting help—whether by hiring a bookkeeper, outsourcing to an accounting service, or using accounting software. The P&L helps you compare your sales and expenses and make forecasts.